Recover Unpaid Wages for Restaurant Workers and Tipped Employees in Florida

Understanding Tipped Employee Wage Notices in Florida

The employer must provide the following information to a tipped employee before the employer may use the tip credit:

- the amount of cash wage the employer is paying a tipped employee, which must be at least $2.13 per hour under federal law ($5.03 under Florida law);

- the additional amount claimed by the employer as a “tip credit,” which cannot exceed $5.12 under federal law (the difference between the minimum required cash wage of $2.13 and the current federal minimum wage of $7.25) (In Florida, the employer cannot claim more than $3.02 as “tip credit). Thus, if the employee worked over 40 hours in a week, the employee is still entitled to overtime, but the employer is still limited as to the amount of tip credit that they can take.

- the tip credit claimed by the employer cannot exceed the amount of tips actually received by the tipped employee;

- all tips received by the tipped employee are to be retained by the employee except for a valid tip pooling arrangement limited to employees who customarily and regularly receive tips; and

- that the tip credit will not apply to any tipped employee unless the employee has been informed of these tip credit provisions.

The employer may provide oral or written notice to its tipped employees informing them of items 1 – 5 above. An employer who fails to provide the required information cannot use the tip credit provisions and, therefore, must pay the tipped employee at least $7.25 per hour in wages (under federal law) and allow the tipped employee to keep all tips received.

Legal Boundaries of Tip Pooling in Florida's Hospitality Industry

Employers can require tipped workers to participate in a tip pool. However, the tip pool can only consist of employees who customarily and regularly receive tips such as waiters, waitresses, bussers, bartenders, and barbacks. The tip pool cannot include those who do not customarily and regularly receive tips such as dishwashers, cooks, chefs, janitors, bouncers, and managers. If non-tipped employees are included in the tip pool, this destroys the ability of the employer to take the tip credit and the employee would be entitled to the full minimum wage, and not just the tip credit.

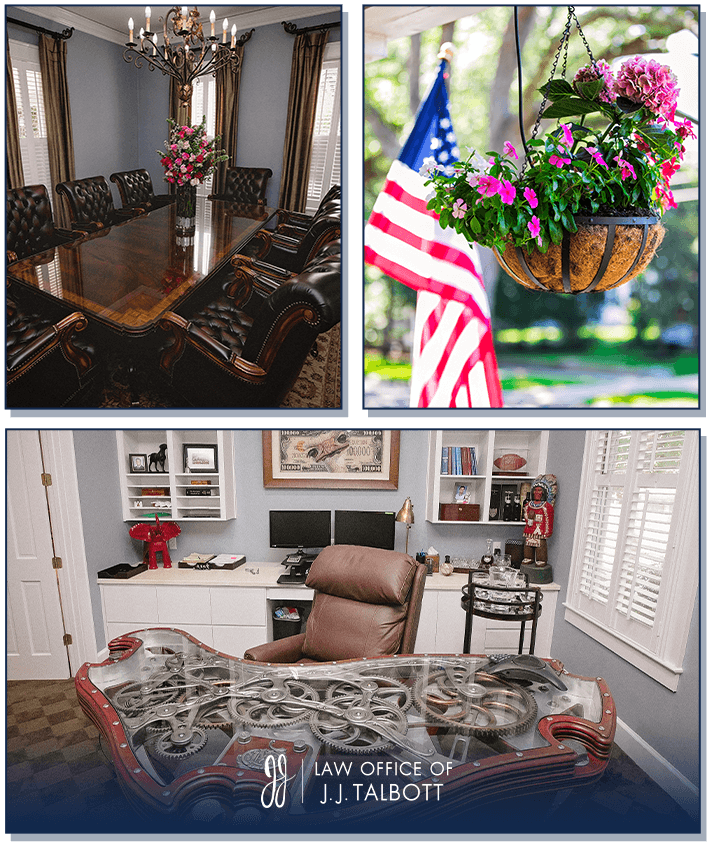

What Sets Us Apart

-

Work Directly With Your Attorney

-

Welcoming and Laid-Back Atmosphere

-

We Always Return Phone Calls Within 24 Hours

-

We Treat Our Clients Like Family

-

Over $100 Million in Recoveries

Our Clients

Say It Best

-

I really appreciated all the hard work that this law firm put in for me and how nice the people were that worked on my behalf.Dewitt L.

-

I was very pleased with the service and the recovery of my lost wages.Ann M.

-

I love you all so much. Thanks for all of your hard work! If I ever need to come back it will be you guys. Thanks.La Rheasa M.

-

Has always done it correctly and thoroughly. You can give complete trust to J.J. and the whole Talbott staff.Brian C.

-

J.J. and his staff have been wonderful assisting both myself and friends in a balcony collapse. We could not have made it through this process without them and I highly recommend them to anyone needing legal assistance. They explained every step of the process as we went through it and they definitely had our best interest at heart.Amanda M.

-

The Law Office of J.J. Talbott and his assistant Holly were very good at working my case to get me the maximum amount of money that I was entitled to. J.J. always personally returned phone calls and explained to me in detail what we were doing along the way. Thank you so much for everything!Darcy C.

-

I used J.J. and his team several years back. I was thinking of him and wanted to let him know how much I appreciated what he accomplished on my behave. I can strongly recommend J.J.’s firm. He is truly a client advocate. Thank you, J.J.!Jeff H.

-

Recently I had a situation in which a low-quality roofing contractor would not pay me what was owed. I brought my case to JJ (he and I went to college together). I knew J.J. was a good guy. At the end of my case, which we won the full amount, J.J. sent me a transcript of his correspondence with the opposing counsel. I was able to read his interactions and understand clearly why we won. The case took a year to settle, these things do not happen overnight. My recommendation is to be patient and let the process play out naturally. You will be more satisfied with the service provided. JJ‘s team was awesome as well. Everybody responds to phone calls and emails. I really appreciated the timely correspondence. What I really appreciate is the low-quality roof contractor's stupidity and inability to be honest. They paid triple what they would’ve paid had they just been honest and paid me when I left. Some business owners are really dumb. Thanks J.J. and team. I appreciate you guys.Michael L.

Common Tipped Employee Wage Violations

1) Failure to Provide Notice to the Tipped Employee

The employer must provide the following information to a tipped employee before the employer may use the tip credit:

- the amount of cash wage the employer is paying a tipped employee, which must be at least $2.13 per hour under federal law ($5.03 under Florida law);

- the additional amount claimed by the employer as a “tip credit,” which cannot exceed $5.12 under federal law (the difference between the minimum required cash wage of $2.13 and the current federal minimum wage of $7.25) (In Florida, the employer cannot claim more than $3.02 as “tip credit). Thus, if the employee worked over 40 hours in a week, the employee is still entitled to overtime, but the employer is still limited as to the amount of tip credit that they can take.

- the tip credit claimed by the employer cannot exceed the amount of tips actually received by the tipped employee;

- all tips received by the tipped employee are to be retained by the employee except for a valid tip pooling arrangement limited to employees who customarily and regularly receive tips; and

- that the tip credit will not apply to any tipped employee unless the employee has been informed of these tip credit provisions.

The employer may provide oral or written notice to its tipped employees informing them of items 1 – 5 above. An employer who fails to provide the required information cannot use the tip credit provisions and, therefore, must pay the tipped employee at least $7.25 per hour in wages (under federal law) and allow the tipped employee to keep all tips received.

2) Forced Participation in a Tip Pool that Includes Non-Tipped Workers Such as Dishwashers or Managers

Employers can require tipped workers to participate in a tip pool. However, the tip pool can only consist of employees who customarily and regularly receive tips such as waiters, waitresses, bussers, bartenders, and barbacks. The tip pool cannot include those who do not customarily and regularly receive tips such as dishwashers, cooks, chefs, janitors, bouncers, and managers. If non-tipped employees are included in the tip pool, this destroys the ability of the employer to take the tip credit and the employee would be entitled to the full minimum wage, and not just the tip credit.